Need Cash Fast? Payday Loans UK Direct Lender Options Explained

When unexpected expenses arise or bills pile up, many people find themselves asking, “Need cash fast?” In the UK, payday loans have become a popular solution for short-term financial emergencies. However, navigating the payday loans uk direct lender market can be tricky, especially when looking for direct lender options that are reliable and affordable. This article explains everything you need to know about payday loans in the UK and highlights the benefits of choosing direct lenders.

What Are Payday Loans?

Payday loans are short-term, high-interest loans designed to provide quick cash until your next payday. These loans typically cover small amounts, often ranging from £100 to £1,500, with repayment due within a few weeks or by your next salary deposit.

Many borrowers turn to payday loans when traditional bank loans or credit options are unavailable, making them a convenient financial tool during emergencies.

Why Consider Payday Loans UK Direct Lender Options?

When searching for quick cash solutions, the phrase “Need Cash Fast? Payday Loans UK Direct Lender Options Explained” becomes very relevant. Choosing a direct lender means you deal directly with the loan provider without intermediaries or brokers.

Benefits of Direct Lenders

- Faster Approval and Funding: Direct lenders can often process your application and release funds quicker than brokers.

- Lower Fees: Without middlemen, there are fewer hidden charges, resulting in potentially lower overall costs.

- Clear Communication: You speak directly to the company providing the loan, reducing confusion and improving transparency.

- Better Customer Support: Direct lenders are more accountable for your loan experience and may provide better service.

How to Find Reliable Payday Loans UK Direct Lender Options

Not all payday lenders are created equal. To avoid scams or exorbitant fees, consider these tips:

- Check FCA Authorization: Always choose lenders regulated by the Financial Conduct Authority (FCA) to ensure compliance with legal standards.

- Compare Interest Rates: Some direct lenders offer competitive rates—shop around for the best deal.

- Read Reviews: Customer feedback can provide insight into lender reliability and service quality.

- Understand the Terms: Pay close attention to repayment deadlines and fees to avoid unexpected charges.

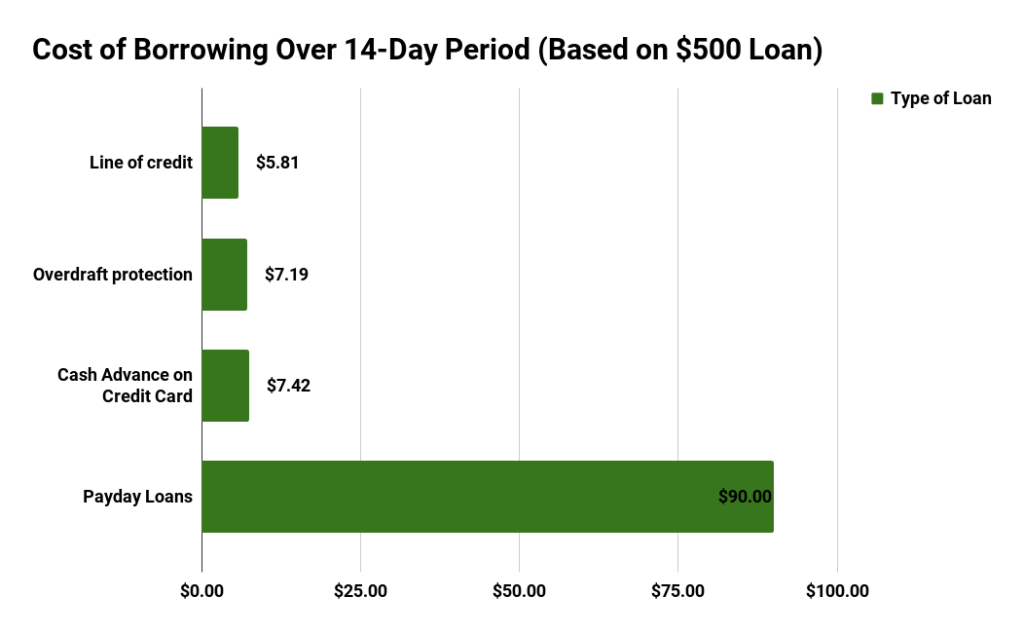

Alternatives to Payday Loans

While payday loans are a quick fix, they can be costly if mismanaged. Consider alternatives like:

- Credit union loans

- Borrowing from friends or family

- Salary advances from employers

- Personal loans from banks or online lenders

Conclusion

If you need cash fast, exploring Payday Loans UK Direct Lender Options can be a viable solution for short-term financial needs. By understanding what payday loans are, choosing direct lenders, and knowing how to select the right provider, you can secure quick funds responsibly and avoid common pitfalls.